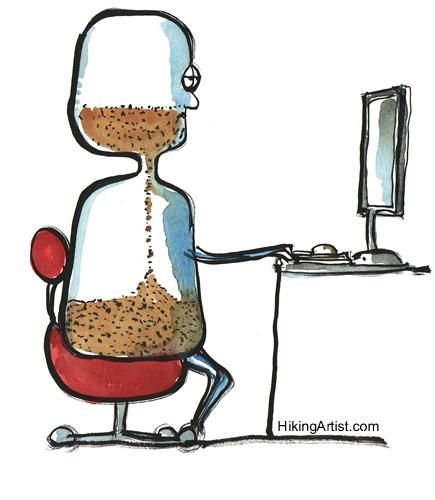

Today I am going to talk about something that is key on trading which is patient. It seems to be easy sometimes to have patient on trading when its needed but is very hard especially for new traders which is adapting to the physiological part of trading.

Never you will find a market which will be in the same trend forever and that is when we see those 'healthy pullbacks'. When I say healthy pullbacks I mean when the market is in a very strong trend and we see the market doing a correction on short-term so more traders can jump into that market into the trend direction. However, that trend will not last forever and the market dynamics change which means that the market will go back to ''range mode''. Keep in mind that the markets has three modes: bullish, range, bearish. When the market is on bullish or bearish trend, its very common for the market to move to range before a full reversal. (eg. bullish trend, goes to range and then to bearish trend).

However, many people do not that patience to wait for the confirmation and this can effect their results very dramatically.

I recommend for you to try more to trade with orders, which gives you the opportunity to wait for the market to get into your price and you won't need to run after the market.

I agree that patient you gain with experience and confidence in yourself with good results but good results comes from a very tight discipline. So, try to trade slowly, you don't need to open many trades or big trades, all it matters first is to get those pips and with time you can start increasing (with correct risk management of course) your trading positions.

I think this is very good topic for your to think when you are free especially during the weekend that the market is closed. I also recommend you to take a break when you don't have good days! Everyone (even pro traders!) has their bad periods and the best thing to do it to take a breath and start again but feeling positive and not increasing your trades so you can get the money back that you lost.

Take you time and be patient!

It's much better for you not being trading than having really bad trades!

I hope this post can make you think about this topic and make you think what you can do to improve your trading.

Have a great weekend and we keep in contact in the chatroom or on Twitter.

By Thiago Duarte

Chief Strategist at Duarte Investment Group

thiago@duarteinvestmentgroup.com

@thiagotrader